Grow & Learn: Credit 101

Did you know that roughly 31% of Americans don’t know their credit score? (Source) Here are some of the most important principles around credit, along with links to learn more.

The Basics

What is a credit score?

Your credit score is the number that lenders reference when you apply for any kind of credit product, like mortgages or credit cards. It’s how they evaluate your creditworthiness.

Poor or no credit can make aspects of your everyday life really difficult. You might get rejected for loans, have a job offer revoked, find yourself unable to rent an apartment, get turned down by credit card companies, and more. If you aren’t rejected, sky-high interest rates can make things more expensive than you can afford. Very Good or Exceptional credit means that you’re likely to be accepted on credit applications, and your rates will be more affordable.

Most credit scores fall under two models: FICO and VantageScore. Many consumers are more familiar with the FICO scoring model and it is the score used by over 90% of lenders. (Source)

What a FICO score means

FICO (formerly known as Fair, Isaac and Company) is a data analytics company. The FICO credit score is a data-based, numerical method of determining how responsible individuals are with credit usage. Lenders use FICO scores to determine if applicants are trustworthy. There is more than one version of FICO, which you can read about here.

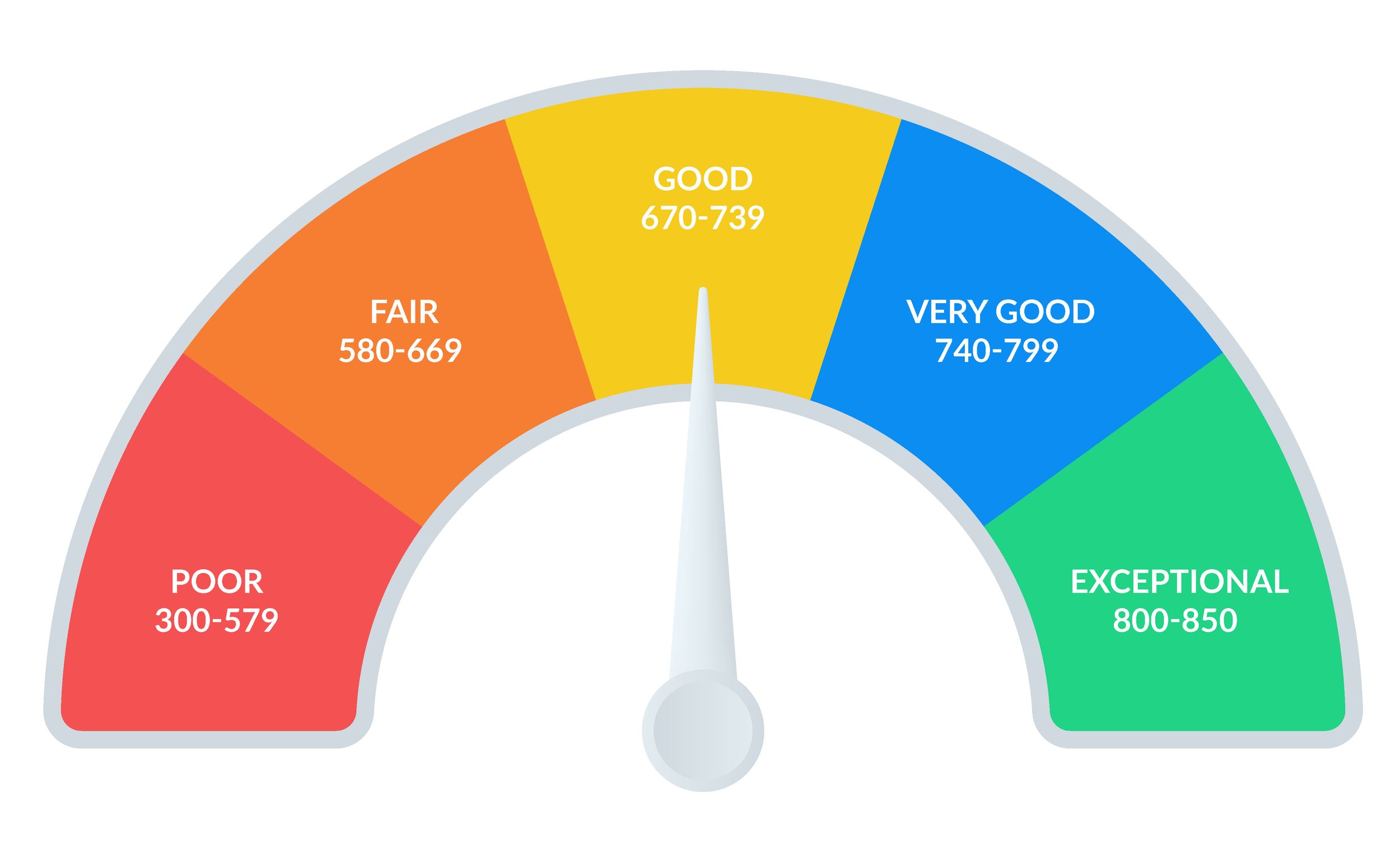

The FICO score uses a scale ranging from 300 to 850, and the numerical scores fall into the following categories:

300-579: Poor

580-669: Fair

670-739: Good

740-799: Very Good

800-850: Exceptional

According to the Consumer Financial Protection Bureau, roughly 22% of Americans have no credit or poor credit. A consumer who doesn’t have enough lines of credit to build a strong score has a “thin credit file.” You can read more here, or get a brief explainer in the section below.

Read more: What a Thin Credit File Is (And How to Fill Out Yours)

Read more: What Is a Good Credit Score?

What Makes Up a FICO Score?

Your credit score is determined by each of the three credit bureaus using complex algorithms that are not publicly available, but we have a basic idea of the elements that make it up, and how much each element accounts for in your total score. Here are the components that make up your credit score, and the approximate percentage that each represents:

Payment history - 35%

Your payment history is whether you pay your bills on time. If you regularly make your payments when they’re due, you should be good to go. But, if you miss a payment, your credit score can drop as much as 180 points, and late payments can stay on your credit for up to 7 years. Because your payment history is the biggest part of your FICO score, it is important to make sure you make your payments on time.

Amounts owed - 30%

Your credit utilization ratio is the proportion of your balances (what you owe) to the maximum credit your lender has allowed you to borrow. For example, if you have a $10,000 loan and a $2,000 balance remaining, your credit utilization ratio is 20%. A lower credit utilization ratio is better, because it shows discipline and that you’re at a lower risk of default. As a general rule, you want to keep your credit utilization ratio under 30%.

Length of credit history - 15%

The longer you have an account on your credit file, the better the length of your credit history. There’s not much you can do to improve this aspect of your credit, but there is one little-known loophole: if you can convince a family member to add you to one of their older lines of credit as an authorized user, their account will be added to your report. This isn’t an option that is available for everyone, but if you can swing it, it’s a good hack. Otherwise, get started with opening lines of credit now, and let time do the rest of the work.

Credit mix - 10%

There are different types of credit, including revolving credit and installment loans. (See below for more information.) Having a variety of credit products contributes positively to your credit mix.

New credit - 10%

When you apply for a loan or credit product, most lenders will do a “hard pull” on your credit file, otherwise known as an inquiry. A few hard inquiries aren't a big deal, but having too many inquiries on your file may affect your credit score negatively. (Note: Grow Credit does not do a hard pull on your credit file when you apply for an account.)

Read more: How Do Inquiries Affect Your Credit?

Read more: Why is My Credit Score Low After Getting a Credit Card?

Read more: What’s in my FICO Scores?

What doesn’t affect your FICO score?

According to MyFICO, there are several things that do not affect your credit score, including your income, location, and certain types of inquiries or requests.

What’s a VantageScore?

The VantageScore is a credit scoring system developed in a joint effort by Equifax, Experian, and TransUnion to create a more predictive and consistent credit scoring system. It works similarly to a FICO score, but it’s used less often. FICO and VantageScores evaluate credit with most of the same data points, but they’re weighed differently. Since 90% of lenders use the FICO model to evaluate creditworthiness, Grow helps you track your FICO score. For the curious, you can read more about the differences at the link below.

How Grow Credit Affects Each Element of a FICO Score

A quick refresher on how Grow Credit works:

Grow Credit issues a micro loan and provides a virtual debit Mastercard for you to access the loan funds to pay for supported subscriptions. Each month, you repay what you actually charge to the card, and that’s reported to the credit bureaus as a loan payment. While it may seem like a credit card, your Grow Credit account is reported as an installment loan, not a revolving line of credit.

So now that you get the basic principle, here’s how Grow’s method of building credit affects each of the categories that make up your FICO score.

Payment history

Having your on time payments to Grow Credit reported to all three credit bureaus every month adds to your positive payment history.¹ If you’re enrolled in automatic ACH or debit payments, you don’t have to worry about missing one.²

Amounts owed

Your monthly spending limit ranges from $17 to $150, depending on your eligibility and which plan you’ve chosen. But we report it as an annual line of credit, totaling your monthly spending limit times 12 (between $204 and $1800). That keeps your credit utilization at 8.33% of your annual limit, which puts you far below the recommended 30% credit utilization ratio.

Length of credit history

Adding more lines of credit increases the average age of your credit accounts. (Note that opening a new account may have a slight negative impact by reducing that average, but that effect is temporary).

Credit mix

As we’ve mentioned, it is important to have a variety of credit types in your report. Your Grow Credit account is reported as a line of credit, so including that with a mix of revolving accounts (credit cards) and installment loans (like a car loan or student loans), may help improve your credit mix.

New credit

Grow Credit doesn’t do a hard credit pull when you open your account. Instead, we use other underwriting criteria and run a soft pull for identity verification purposes only. While a soft pull will appear on your credit report, it won’t have a negative effect on your credit score.

In short, Grow Credit may have a positive impact on the factors that make up 90% of your credit score, depending on your individual circumstances, and it doesn’t affect the other 10% that could negatively affect you. It works astonishingly well, in our humble opinion. Pretty genius, right? Who knew that you could affect your credit score that much just by taking 5 minutes to set up an account and then changing the payment method for one of your streaming services?

Types of Credit

There are three main types of credit accounts: revolving, installment, and open. To help build your credit, you want both revolving and installment accounts on your credit report, because that will increase your credit mix (see above). Here’s a breakdown of the difference:

Revolving credit account: A revolving credit account is a line of credit you can borrow from freely, but your account has a cap known as a credit limit. A credit limit is how much you can use at a time. Revolving credit accounts usually require monthly payments and charge interest if you carry a balance. Common types of revolving credit include credit cards and home equity lines of credit (HELOCs).

Installment credit account: Installment credit is a set amount of money given to a borrower that demands fixed, recurring payments. Popular types of installment credit include student loans, mortgages, auto loans, and personal loans. Installment credits are the most commonly used.

Open credit: Open credit is rarer and most people won’t see this credit on their credit reports. With an open credit account, you borrow a set, maximum amount each month to be paid back in full before the end of this month. Open credit is associated with charge cards—not to be confused with credit cards.

Read more: Types of Credit

Can a debit card help me build my credit score?

The short answer is no, a debit card cannot help you build credit, with very few exceptions. Here’s why: Your debit card is directly linked to your checking account. When you’re purchasing something with your debit card (and when you’re not making use of an overdraft), it’s your own money—and only your money—that’s being used. The basic principle behind quantifying creditworthiness with a credit score is determining how good you are at handling money that isn’t yours, but has been loaned to you.

Read more: Does a Debit Card Build Credit?

Closing Credit Accounts Can Hurt

Your Score. Here’s Why

It might feel good to pay off and close an old credit card account, but you should try to keep that account open and use it sparingly, if possible. Having more positive data points on your credit report is better, and removing one by closing an account might reduce your score. You might shorten your average length of credit (depending on your situation), your credit mix might become less diversified, and you’re likely to increase your credit utilization ratio by lowering your maximum credit line.

If you’re feeling frustrated and considering closing your Grow account, don’t. We’re not saying that just because we don’t want to lose you as a customer (and we certainly don’t!), but because it’s genuinely not in your best interest, and our priority is to help our customers.

If you’re having trouble with your account, please contact customer support by clicking on the icon on the bottom right-hand corner of this page to chat, emailing us at behappy@growcredit.com, or by calling our phone support line at 1 (888) 244-5886.

It is best to use our automated chat box first so we can narrow down the source of your issue and forward it to the person who can provide the best possible solution. Please be aware there are some requests we can only respond to in writing.

Read More: Why You Should Never Close a Credit Account

Can I Use More Than One Credit-Building Product?

Yes, and you should! Having more lines of credit on your report is a good thing, for the reasons we’ve outlined above. Having a Grow Credit account doesn’t mean that you can’t also use secured cards and other credit-building products. There are also reasons that using one credit product might not cover all of your needs. For example, Experian Boost can help your Experian score, but it doesn’t report to TransUnion or Equifax. Lenders usually reference all three scores when they evaluate you for loans. You can read more about other credit-building products below.

Read more: Can I use more than one credit-building method at a time?

How Do I Get Started on Raising My Score?

Building credit can be a marathon. Keep in mind that many credit products take up to 90 days to report to the bureaus, so it may take a few months for your early efforts to make an impact. Here are some easy steps to get started on your credit-building journey:

If you haven’t already, sign up for Grow Credit so you can start getting your subscription payments reported to the bureaus.

Go to annualcreditreport.com and request your report. Currently, you’re entitled to free weekly reports from each of the bureaus. Look out for any errors to dispute. Read more about disputing errors here.

We know it’s stressful, but if you have delinquent or defaulted balances, it’s time to handle those. There shouldn’t be any delinquencies or defaults on your report that are over 7 years old. (If there are, follow the directions in this article.) If there are delinquent accounts less than 7 years old, how you handle them depends on your situation. You can read more about the steps you can take here.

If you can, consider paying down your balances to get your credit utilization under 30%. See the “Amounts Owed” section of the “What Makes Up a FICO Score?” section above.

You can add more lines of credit to your report by using self reporting services, like Experian Boost or Self.

Make sure you have both revolving and installment accounts on your report.

Once you have these in order, it’s just a matter of keeping good habits and letting your score grow with time. Here at Grow, we’re committed to doing everything we can to help our customers build a strong financial future.

To learn more about credit, keep an eye out for our newsletter, and make sure to check out our blog, where we expand on these topics and many more.

Not a member of Grow yet? 🌱

¹Grow Credit helps you build credit by reporting consistent, on time payments. Under the terms of your loan agreement and disclosure statement, we reserve the right to report payment delinquencies at or in excess of 30 days to one or more consumer reporting agencies in accordance with applicable law. You can find your loan agreement in your account settings by tapping your initials on the bottom right corner on the app or clicking the silhouette icon on the website.

² For customers enrolled in autopay (ACH or debit), we'll automatically process the payment with your default payment method on the due date. If our system detects a low balance or another issue, we send a notice to the email address on the account. Disputed or repeated failed payments may result in automatic ACH payments being disabled on accounts.